The double-declining balance method doubles the straight-line rate for faster depreciation. With a 20% straight-line rate for the machine, the DDB method would use 40% for yearly depreciation. The disposal value, also known as gross proceeds, is the amount received when selling or disposing an asset. The first step is to determine this value by determining market prices for similar assets, referencing professional appraisals, or negotiating with potential buyers. Salvage value is a commonly used, if not often discussed, method of determining the value of an item or a company as a whole.

Salvage Calculation

Conversely, if there is high demand for a particular type of asset, the salvage value may increase. The condition of the asset is an essential factor in determining its salvage value. An asset in good condition is likely to have a higher salvage value compared to one that is damaged or in poor condition. The better the condition, the more valuable the asset is likely to be in the salvage market. Suppose a company spent $1 million purchasing machinery and tools, which are expected to be useful for five years and then be sold for $200k.

Strategic Decision Making

By integrating financial data and automating calculations, Deskera ERP ensures accuracy and consistency in determining salvage values across various asset categories. The straight-line method is a way to calculate depreciation by evenly spreading the asset’s cost over its useful life. This method assumes that the asset’s value decreases at a constant rate over time. Next, the annual depreciation can be calculated by subtracting the residual value from the PP&E purchase price and dividing that amount by the useful life assumption.

- Or, if they want to show more expenses early on, they might use a method that makes the item lose more value at the beginning (accelerated depreciation).

- Salvage value is a commonly used, if not often discussed, method of determining the value of an item or a company as a whole.

- The salvage or the scrap value is estimated when the useful life of an asset is over and can’t be used for its original purpose.

- Some methods make the item lose more value at the start (accelerated methods), like declining balance, double-declining balance, and sum-of-the-years-digits.

Depreciation Rate:

Moving on, let’s look through the details of how the salvage value can be used in depreciation calculations. The salvage or the residual value is the book value of an asset after all accounting definition the depreciation has been fully expired. By the end of the PP&E’s useful life, the ending balance should be equal to our $200k assumption – which our PP&E schedule below confirms.

Calculating depreciation with consideration of the salvage value ensures that the asset’s cost is accurately spread over its useful life. This provides a true reflection of the asset’s value and helps in presenting a more accurate financial position of the company. It is is an essential component of financial accounting, allowing businesses to allocate the cost of an asset over its useful life.

How Does the Salvage Value Calculator Beneficial?

Some methods make the item lose more value at the start (accelerated methods), like declining balance, double-declining balance, and sum-of-the-years-digits. The depreciable amount is like the total loss of value after all the loss has been recorded. The four depreciation methods available are straight-line, units of production, declining balance, and sum-of-the-years’ digits. The choice of method depends on the nature of the asset and its expected pattern of use and obsolescence. Imagine you are an employee of a mid-sized company tasked with evaluating the financial viability of a major equipment upgrade. The current machinery, after years of service, is approaching the end of its useful life.

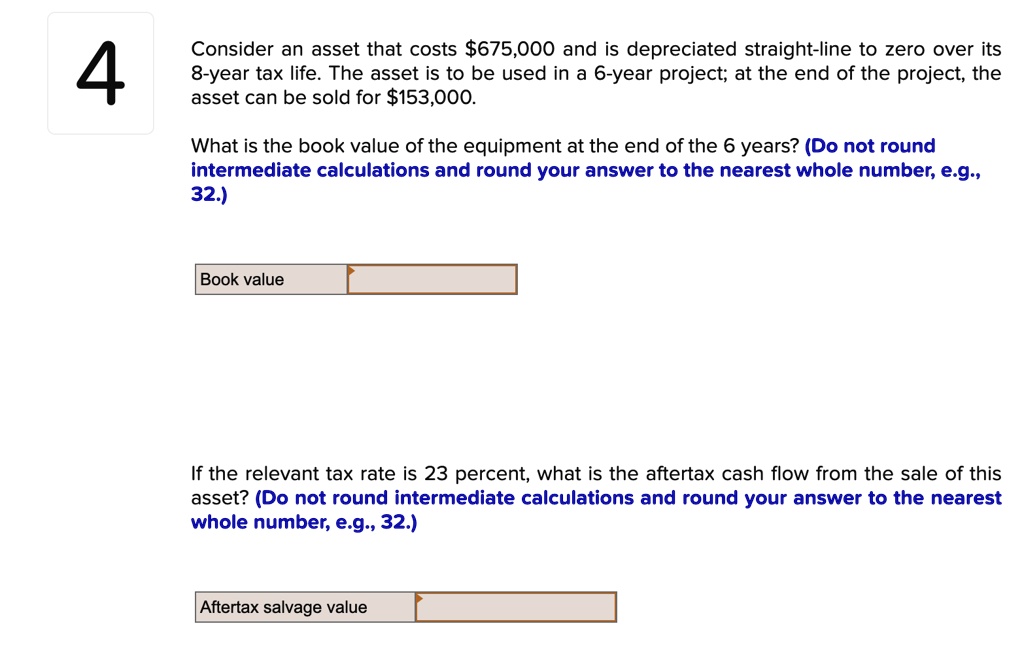

When calculating depreciation, an asset’s salvage value is subtracted from its initial cost to determine total depreciation over the asset’s useful life. From there, accountants have several options to calculate each year’s depreciation. An asset’s salvage value subtracted from its basis (initial) cost determines the amount to be depreciated. Most businesses utilize the IRS’s Accelerated Cost Recovery System (ACRS) or Modified Accelerated Cost Recovery System (MACRS) methods for this process. If your business owns any equipment, vehicles, tools, hardware, buildings, or machinery—those are all depreciable assets that sell for salvage value to recover cost and save money on taxes.

Some companies might say an item is worth nothing (zero dollars) after it’s all worn out because they don’t think they can get much. But generally, salvage value is important because it’s the value a company puts on the books for that thing after it’s fully depreciated. It’s based on what the company thinks they can get if they sell that thing when it’s no longer useful. Sometimes, salvage value is just what the company believes it can get by selling broken or old parts of something that’s not working anymore. Calculating after tax salvage value is an essential aspect of managing assets and making informed financial decisions for businesses and individuals alike. When calculating depreciation in your balance sheet, an asset’s salvage value is subtracted from its initial cost to determine total depreciation over the asset’s useful life.